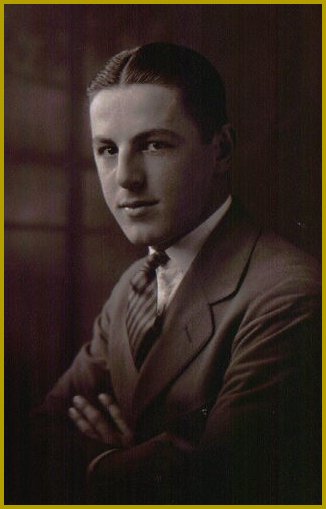

Todd M. Ryan |

Todd M. Ryan |

Founded Ryan Consulting LLC in 1998 in order to help clients to integrate

their financial, strategic, and performance goals. Extensive experience in the

architectural/engineering/construction, consumer products, and healthcare industries.

Founded these Arthur Andersen service lines: Corporate finance in 1985, corporate development outsourcing in 1995, and performance improvement in 1996. Partner in charge of corporate finance until1998.

Key strengths: problem solving and innovation. An articulate proponent of shareholder value creation.

Moves easily between macro and micro issues.

Developed new services for Andersen’s corporate finance and specialty

consulting groups, including:

-Corporate development outsourcing

-An enhanced form of shareholder value measurement and creation

-Capability-based strategy

-Integrated corporate finance and strategy reviews

-Lowering the cost of capital through targeted financing of business units.

One quarter of all assignments has been international.

CURRICULUM VITAE

PRESENT TITLE: CEO, Ryan Consulting LLC

EDUCATION AND DEGREES:

University of Wisconsin – Milwaukee

BA Psychology 1970

B.Sc. Math/Chemistry 1971

Ms. Statistics 1974

University of Wisconsin – Madison

Completed coursework for Ph.D. Economics (Finance) 1976

PROFESSIONAL QUALIFICATIONS:

Industry concentration includes Engineering/Construction, Healthcare, and consumer products.

Professional expertise includes strategy, planning, corporate finance, mergers and acquisitions, and shareholder value improvement.

CORPORATE FINANCE CONSULTING AND RELEVANT CLIENT EXPERIENCE:

Acted as M&A or financial advisor on several hundred acquisitions, divestitures, joint ventures, start-ups, recapitalizations, IPOs and other special purpose financings, some private placements under Rule 144(a). Usually worked from the origination stage through closing. Used a variety of entity forms, including general partnerships, limited partnerships, LLPs, LLCs, and S-Corps. Deals ranged in size from $4.0MM to $4,000MM.

Worked with lenders and other financing sources to structure favorable funding terms for clients, some of who were under-performing.

Negotiated most deals so that all business points were resolved, resulting in minimal lawyer debates and reduced transaction cost.

Developed corporate governance model for major new client. Was adopted and is in use today.

Performed or managed over 500 business valuations of U.S. and international companies.

Provided strategic planning assistance on acquisition/divestitures in many industries. Size of deals ranging from $40MM to $4,000MM.

Provided takeover defense and shareholder value improvement consultation for several large publicly held clients.

Provided due diligence service, including risk assessment, for a number of commercial lenders and investment principals.

Assisted several management and outsider groups in structuring, financing, and executing leveraged buyouts of their businesses.

Assisted several buyer clients in developing an effective post-acquisition integration plan for their new businesses.

PRIOR AFFILIATIONS AND POSITIONS:

1988-1998

Arthur Andersen LLP

Partner-Corporate Finance

Member U.S. Private Placement Committee

Member Japanese International Network

1985-1988

Arthur Andersen, S.C.

Manager Corporate Finance

1979-1985

Philip Morris Cos.

Director Planning (non-tobacco businesses)

1974-1979

Miller Brewing Co.

Sr. Manager Sales Services and Development

1972-1974

Falk Corporation

Sr. Operations Research Analyst

1969-1972

Falk Corporation

Materials Chemist

PROJECT EXPERIENCE

Shareholder value improvement

Designed risk-based project bidding and acceptance procedures for the AEC industry

Strategy consulting

Corporate development

Profit improvement

Evaluation and negotiation of:

Equity-sharing joint ventures or other investment entities

Contractual agreements to allocate earnings and profits among participants

Regionally exclusive relationships, such as between the firm and a supplier

or manufacturer

Capital raising

Capitalization of subsidiaries and business units

Mergers and acquisition assistance

Critical process mapping/alignment

Todd Michael Ryan Personal Comments:

I seek a chief financial officer or similar position with a larger, fast growing, transaction-oriented firm whose energy matches my own. I have had similar positions with increasing responsibility for most of my career. I am a builder and a problem solver rather than a caretaker. My communication skills are excellent.

I prefer to stay in the Chicago area, which gives me easy airline access to most major cities. My travel schedule has always been heavy. I expect that to continue. About one quarter of my work has been international. I am accustomed to long hours, working at client sites four days per week.

I have had my own consulting firm since 1998. I have two associates. The work is rewarding and I enjoy my clients, but my limited people resources have precluded me from accepting longer-term assignments. As a result, I have not yet developed a satisfactory business backlog.

The Board of Directors | An International Directory of Curriculum Vitae For Those Possessed Of, As Well As Those In Search Of Proven Leadership Abilities. |  |